City of Milwaukee Alderwoman Nikiya Dodd proposed a 60 cent fee for Uber/Lyft, which are third-party delivery services, which the fee is also supported by Wisconsin State Senator Lena Taylor and Milwaukee County Supervisor Sylvia Ortiz-Velez, which would add millions of dollars to the City budget designated to fix pot holes and streets.

By H. Nelson Goodson

Hispanic News Network U.S.A.

January 16, 2020

Milwaukee, Wisconsin - Wisconsin State Senator Lena Taylor (D-Milw.) had sought a legal opinion from the Wisconsin Reference Bureau and the Wisconsin Legislative Council, whether local municipal governments could enact service fees to third-party delivery services under WI State Statues 440.465 (1), for the transportation network companies (TNC) in the state. Two state legislative entities agreed that a service fee for third-party delivery services can be enacted by local municipalities including the City of Milwaukee.

Hispanic News Network U.S.A. (HNNUSA) learned that in a recent response, David Moore, the Senior Staff Attorney for the Wisconsin Legislative Council wrote in correspondence, "You asked the following two questions related to the local regulation of third-party food delivery

services:

1. Does s. 440.465 (1), Stats., which generally preempts local units of government from regulating transportation network companies or transportation network services, preempt local regulation of third-party food delivery services?

2. If regulation of third-party food delivery services is not preempted under s. 440.465 (1), Stats., may a local unit of government impose a fee on third-party food delivery services?

As will be described in more detail below, the answer to your first question is that s. 440.465 (1), Stats., does not preempt a local unit of government from enacting or enforcing an ordinance that regulates third-party food delivery, because a third-party food delivery service is not a "transportation network

company" as defined by statute. As will also be described in more detail below, a local unit of

government may only impose a fee if the fee bears a reasonable relationship to a service provided by the

local unit of government."

Also, Konrad Paczuski, the legislative attorney for the Wisconsin Legislative Reference Bureau wrote in response, "You have asked whether state statutes that regulate transportation network services would limit local governments from regulating food delivery arranged through a digital network.

It is likely that the state statutes that regulate transportation network services do not limit local regulation of food delivery arranged through a digital network."

According to Urban Milwaukee, "The idea for the fee originated with Milwaukee County Supervisor Sylvia Ortiz-Velez who approached Taylor about a state law change allowing Milwaukee County to add a per-ride tax to transportation network companies (TNC) like Uber and Lyft. The supervisor told the committee she is seeking the county tax to respond to an increase in potholes and decline in Milwaukee County Transit System revenue that she said are a result of the app-based services."

City of Milwaukee Alderwoman Nikiya Dodd proposed a 60 cent fee for Uber/Lyft, the third-party delivery services, which the fee is also supported by Wisconsin State Senator Lena Taylor and Milwaukee County Supervisor Sylvia Ortiz-Velez, which would add millions of dollars to the City budget designated to fix pot holes and streets.

For example, in 2015, the Wisconsin Department of Revenue (DOR) reported that the State collected $1,377,329,811 per year in combined taxes from the City of Milwaukee and the State distributed at least $249.90M in share revenue and in 2018, Milwaukee received at least $228.20M in share revenue and in 2019, it received $229.30M in share revenues.

The WI Department of Revenue in 2015, ceased to publicly report the combine taxes collected from each municipality and ect. and the amount of share revenue it distributed to each municipality and ect.

"The State Department of Revenue used to prepare a report, “State Taxes and Aids by Municipality and County”. This report broke down dollars sent back to each municipality in the form of shared revenue, school levy tax credit, lottery credit, aids, etc., and also provided estimates as to how much state-collected income tax, corporate tax, sales tax, excise (gas) tax, utility tax, etc., could be attributed to a municipality. The State discontinued this report in 2015, which is why the data hasn’t been updated in the 2020 Plan and Budget Summary. While I can get the various State payments to the City for any given year, the DOR reports only a single, state-wide figure for most of its tax collections. One exception is sales tax collections, which are reported at a county level."

Editor's note: Why is Alderwoman

Nikiya Dodd proposing a 60 cent fee for TNC third-party delivery services like Uber/Lyft in the City of Milwaukee and Wisconsin State Senator Lena Taylor including Milwaukee County Supervisor Sylvia Ortiz-Velez supporting such fees for street repairs including fixing pot holes?

Nikiya Dodd proposing a 60 cent fee for TNC third-party delivery services like Uber/Lyft in the City of Milwaukee and Wisconsin State Senator Lena Taylor including Milwaukee County Supervisor Sylvia Ortiz-Velez supporting such fees for street repairs including fixing pot holes?

Simply because, every year the City faces at least a $20M gap in its budget to operated efficiently and members of the Milwaukee Common Council have to find alternative options to generate revenue, since it doesn't have State authority to tax, but can provide service fees to generate revenue.

Another issue affecting local tax revenue, the City pays its share of combined tax revenue to the State and in return, the State distributes a share revenue to the City to operate, but through the years, the share revenue for the City has declined. In brief, the City pays the State more tax revenue than what the State returns to the City in share revenue.

For example, in 2015, the Wisconsin Department of Revenue (DOR) reported that the State collected $1,377,329,811 per year in combined taxes from the City of Milwaukee and the State distributed at least $249.90M in share revenue and in 2018, Milwaukee received at least $228.20M in share revenue and in 2019, it received $229.30M in share revenues.

The WI Department of Revenue in 2015, ceased to publicly report the combine taxes collected from each municipality and ect. and the amount of share revenue it distributed to each municipality and ect.

"The State Department of Revenue used to prepare a report, “State Taxes and Aids by Municipality and County”. This report broke down dollars sent back to each municipality in the form of shared revenue, school levy tax credit, lottery credit, aids, etc., and also provided estimates as to how much state-collected income tax, corporate tax, sales tax, excise (gas) tax, utility tax, etc., could be attributed to a municipality. The State discontinued this report in 2015, which is why the data hasn’t been updated in the 2020 Plan and Budget Summary. While I can get the various State payments to the City for any given year, the DOR reports only a single, state-wide figure for most of its tax collections. One exception is sales tax collections, which are reported at a county level."

"According to the Budget Office, using the DOR report, in 2015, $1,377,329,811 in State-collected revenue came from Milwaukee," Dana Zelazny, the City of Milwaukee Legislative Reference Bureau reported to Hispanic News Network U.S.A. (HNNUSA).

In other words, the State has stopped compiling the big numbers for taxpayers, since 2015, to avoid, scrutiny, questions from taxpayers and for taxpayers to demand their fair allotment of share revenues for their municipalities and ect., since they pay more than enough taxes in the state.

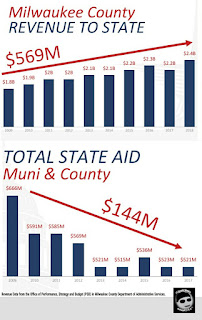

Also in the Milwaukee County level, the County paid the State nearly $3B per year in combined taxes and the State distributes at least 9% (nearly $250M) in share revenues to Milwaukee County to operate per year.

In 2018, Milwaukee County taxpayers sent $569 million more to the State of Wisconsin than they did in 2009. This reflects an increase in income taxes, sales taxes, and other taxes sent to the State. At the same time, the State returned $144 million less to Milwaukee County and its municipalities. The attached slides show the changes year-over-year. I’ll highlight that the $144m reduction includes specifically funding the County and municipal governments. It does not capture funding that is sent to school districts, human service programs which are not run by the County, other non-county/municipal programs, according to Joe Lamers, the Director for the Office of Performance, Strategy and Budget (PSB) in Milwaukee County Department of Administrative Services.

In 2018, Milwaukee County taxpayers sent $569 million more to the State of Wisconsin than they did in 2009. This reflects an increase in income taxes, sales taxes, and other taxes sent to the State. At the same time, the State returned $144 million less to Milwaukee County and its municipalities. The attached slides show the changes year-over-year. I’ll highlight that the $144m reduction includes specifically funding the County and municipal governments. It does not capture funding that is sent to school districts, human service programs which are not run by the County, other non-county/municipal programs, according to Joe Lamers, the Director for the Office of Performance, Strategy and Budget (PSB) in Milwaukee County Department of Administrative Services.

In essence, both the City of Milwaukee and Milwaukee County pay the State sufficient combined tax revenues and in return, both the City and County get less in share revenue, which is highway robbery and taxpayers should be up in arms complaining to their State legislators of the disparity and a lack of sufficient share revenues for their City and County to operate efficiently.

This is not a partisan issue, but a non-partisan issue affecting every taxpayer in every municipality, village and town in the State of Wisconsin.

So next time a local taxpayer complaints about a local elected official who is attempting to enact service fees or thinking out of the box to generate revenues to operate their municipalities efficiently, blame the State for scamming excessive combined taxes and distributing less share revenue to municipalities to operate efficiently.

No comments:

Post a Comment