The City of Milwaukee, since it's the largest municipality in the State pays more taxes in Share Revenue to the State of Wisconsin than any other municipality and gets less from Share Revenue to operate efficiently, according to Wisconsin Share Revenue tax records.

By H. Nelson Goodson

Hispanic News Network U.S.A.

June 27, 2023

Milwaukee, Wisconsin - On Monday, the City of Milwaukee Steering and Rules Committee held a public meeting to discuss the acceptance of a 2% sales tax that was included in the Act 12 Bill, which included multiple provisions mandated by the bill, it also included an additional 10% supplement Share Revenue increase of $21.7M and how it should be used (spent) for Milwaukee only (no other municipality in the State received similar mandatory provisions in their 10% supplement increase of Share Revenues) that was passed by the Republican controlled legislature and signed into law by Governor Tony Evers (D) a week ago.

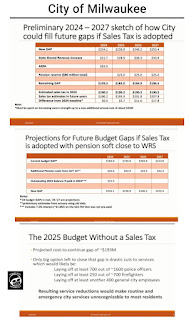

Most of those City officials at the hearing on Monday, also some members of the Steering and Rules Committee seemed to favor a tax increase (no vote was taken at the hearing to increase a sales tax) and others at the meeting as well who were in favor of the 2% sales tax increase that will generate at least $190.2M in 2024, $195.9M in 2025, $201.8M in 2026 and $207.8M, if adopted by the Milwaukee Common Council in July.

Currently, the City of Milwaukee receives at least $219.4M in Share Revenues from the State. Last year, in 2022, the City received $219.1M; in 2021, $219.1M; in 2020, $219.1M and 2001, it received $240M in Share Revenues from the State showing that the City is getting less today. Hispanic News Network U.S.A. (HNNUSA) found no information on the City Budget management website and the Wisconsin Share Revenue website that would actually show how much the City of Milwaukee pays the State in Share Revenue taxes per year.

At the hearing on Monday, Nik Kovac, the Budget and Management Director didn't mentioned or provided the total amount that the City pays the State in Share Revenue (per year) for the last few years, so the public could have a better understanding of the actual formula of tax dollars paid to the State concerning Share Revenue. The City budgets do show how much Share Revenue, the City received per year, but it fails short to show how much the City actually pays the State in Share Revenue per year.

When HNNUSA contacted Kovac to acquire the total tax dollar amounts that the State gets from the City of Milwaukee per the following years, 2023, 2022, 2021 and 2020, he said that the Budget and Management Division office doesn't actually know, since the State automatically collects it. Kovac says, that his Budget office does include what the State returns in Share Revenue to the City per year in the annual City Budget.

What does it indicate? Well, it shows that the City of Milwaukee taxpayers do pay more than enough of their fair share of taxes per year, but the State takes most of the taxes and returns less in Share Revenue to the City, so it can operate efficiently.

HNNUSA could only find that in 2015, the City paid nearly $1.4B in Share Revenue to the State and Milwaukee received $912M in State aid, and most likely today, it pays more and gets less in return.

Today, the City is operating on an estimated deficit (Gap) of more than $180M and by 2024, it will operate with an estimated $254.1M; in 2025, $236.9M; in 2026, $246.2M and in 2027, $255.4.

If the City doesn't approve a 2% sales tax, by 2025, the City will operate with an estimated $193M Gap. The only option to close the Gap, 700 of 1,600 Milwaukee police officers will have to be laid-off, 250 of 700 firefighters will be laid-off and at least another 400 general City employees, according to Kovac.

The Steering and Rules Committee approved a resolution #230359 (https://tinyurl.com/3tpu2ac5) for the City Attorney's Office to review the City's opposition to various provisions in the Wisconsin Act 12 and directed City Representatives to work for their appeal, which indicates that the Milwaukee Common Council is contemplating in filing a legal challenge against the State of Wisconsin for discrimination due to the multiple provisions (restrictions and penalties including in Act 12, if the City doesn't comply) that were included for the City of Milwaukee and no other municipalities in the State.

The Republican controlled legislature has been targeting the City of Milwaukee for decades by returning less Share Revenue to the City in order for it to fail, so that Republicans can take control of the City, which has a huge Democrat voting base that was instrumental in electing Governor Evers (D) twice. And what does Governor Evers do to repay Milwaukee voters and taxpayers, he signs Act 12 into law to screw the City of Milwaukee and its taxpayers. Governor Evers has no shame! Evers got $1B for education (schools) from the Republican controlled legislature.

It's about time that the Milwaukee Common Council reject the 2% sales tax increase, since City taxpayers who pay more than enough taxes already shouldn't be forced to face the burden of paying more taxes that the State will eventually take its share.

The Milwaukee Common Council should legally challenge Act 12 and fight to get more of its fair share of Share Revenues to operate efficiently today and tomorrow.

Those who support a 2% sales tax increase are definitely fools, because taxpayers already pay more than enough taxes, but get less in Share Revenue, which definitely could be considered illegal, if legally challenged and a sham that has taken place for decades.

The State of Wisconsin recently reported a $7B surplus.

In Milwaukee County, the County pays nearly $3B in Share Revenues to the State and the State returned $230M in Share Revenue in 2022 to operate efficiently. Each year, the County reports more than $20M in deficit. In 2003, the County received $250M in Share Revenues from the State, which indicates that the County is getting less Share Revenue from the State. https://county.milwaukee.gov/EN/Board-of-Supervisors/Fair-Deal

The County under Act 12 will have the option to approved a O.04% sales tax increase that would generate $76M per year. Currently, the County has a 0.5% sales tax.

When contacted by HNNUSA, the Wisconsin Department of Revenue released the following tax information by County.

• In 2020, Milwaukee County paid in personal income tax, a total of $48.2B. $48.2B × 6% tax burden = $2.9B in state taxes.

• Milwaukee County makes up about 14.8% × $19.29B in FY21, GRP taxes = $2.85B (a different method with

similar answer)

• It can be surmised that approximately $2.9B in state taxes is generated by Milwaukee County.

Using the same calculation method, it can be summarized for the following 4 surrounding counties.

• Washington County, $8.73B in personal income × ~6% state taxes = $523.8M

• Ozaukee County, $7.87B in personal income × ~6% = $472.2M

• Waukesha County, $30.85B in personal income × ~6% state taxes = $1.851B

The total is approximately $5.747B in total state taxes from the 4 County region, roughly about $19B collected statewide, according to Patricia A. Mayers, Director of Communications from the Wisconsin Department of Revenue.

Every taxpayer in Milwaukee County and in the City of Milwaukee should be upset and angry that sufficient Share Revenue tax dollars are not being return to both the City and County to operate efficiently.

Taxpayers in both Milwaukee County and the City of Milwaukee should contact their local County Supervisors and City of Milwaukee Alderpersons to tell them "NO" to an increase of sale taxes and to demand that they take legal action (sue the State) to challenge the unfair distribution of Share Revenues (including restrictive provisions) for the City of Milwaukee, and cheating the County of its fair share of revenues, in order, to get more Share Revenues to operate efficiently.

Editors note:

How the two Hispanic State Representatives voted on Act 12 (AB245):

State Representative Marisabel Cabrera (D-Milw.) continuously voted "No" of AB245 (Act 12- SB301).

State Representative Sylvia Ortiz-Velez (D-Milw.) voted "Yes" on Concurrence on June 14, 2023 for AB245 (Act 12- SB301).

Wisconsin State Representative Jessie Rodriguez (R-Oak Creek) co-sponsored AB245/SB301 and voted "No" on Concurrence on June 14, 2023.

Wisconsin State Senator Rachael Cabral-Guevara (R-Appleton) introduced SB301/AB245 and approved to pass.

No comments:

Post a Comment