Was it a conflict of interest for the majority of the Milwaukee Common Council to vote in favor of approving a 2% Sales Tax increase to benefit their own pension growth in the guise that they were preventing the loss of City jobs, instead of letting City taxpayers decided by a referendum vote? The City will face a 7.9% Sales Tax hike for some purchases, where's the outrage?

By H. Nelson Goodson

Hispanic News Network U.S.A.

July 12, 2023

Milwaukee, Wisconsin - On Tuesday, July 11, 2023, the Milwaukee Common Council on a vote of 12-3 passed the 2% sales tax increase.

What a bunch of fools! The City will face a 7.9% Sales Tax hike for some purchases, where's the outrage?

Any public elected officials that support and votes for a tax increase without a fight to get additional Share Revenues from the State, shouldn't be re-elected.

Alders that voted in favor of the 2% Sales Tax:

Jóse G. Pérez (Council President); JoCasta Zamarripa; Marina Dimitrijevic; Jonathan Brostoff; Robert Bauman; Lamont Westmoreland; Kalif J. Rainy; Larissa Taylor; Michael J. Murphy; Mark A. Borkowski; Scott Spiker and Russell J. Stamper II

Alders that opposed the 2% Sales Tax increase

Andrea M. Pratt; Michele A. Coggs and Mark Chambers Jr.

The 2% Sales Tax increase will go into effect January 1, 2024. It is expected to generate $198M for the City, which most will be used for the City employees pension that continues to increase.

So far, no taxpayer including the City of Milwaukee and Milwaukee County have attempted to challenged or filed a legal challenge against the State of Wisconsin for unfair distribution of Share Revenues.

For example, the City of Milwaukee and Milwaukee County keep the State afloat economically because both contribute the largest combine tax revenue than any other municipality and County in the state. But, both get less in Share Revenue to operate efficiently per year.

In other words, the City and County taxpayers pay more than their fare share of combined taxes, but get less in Share Revenue from the State.

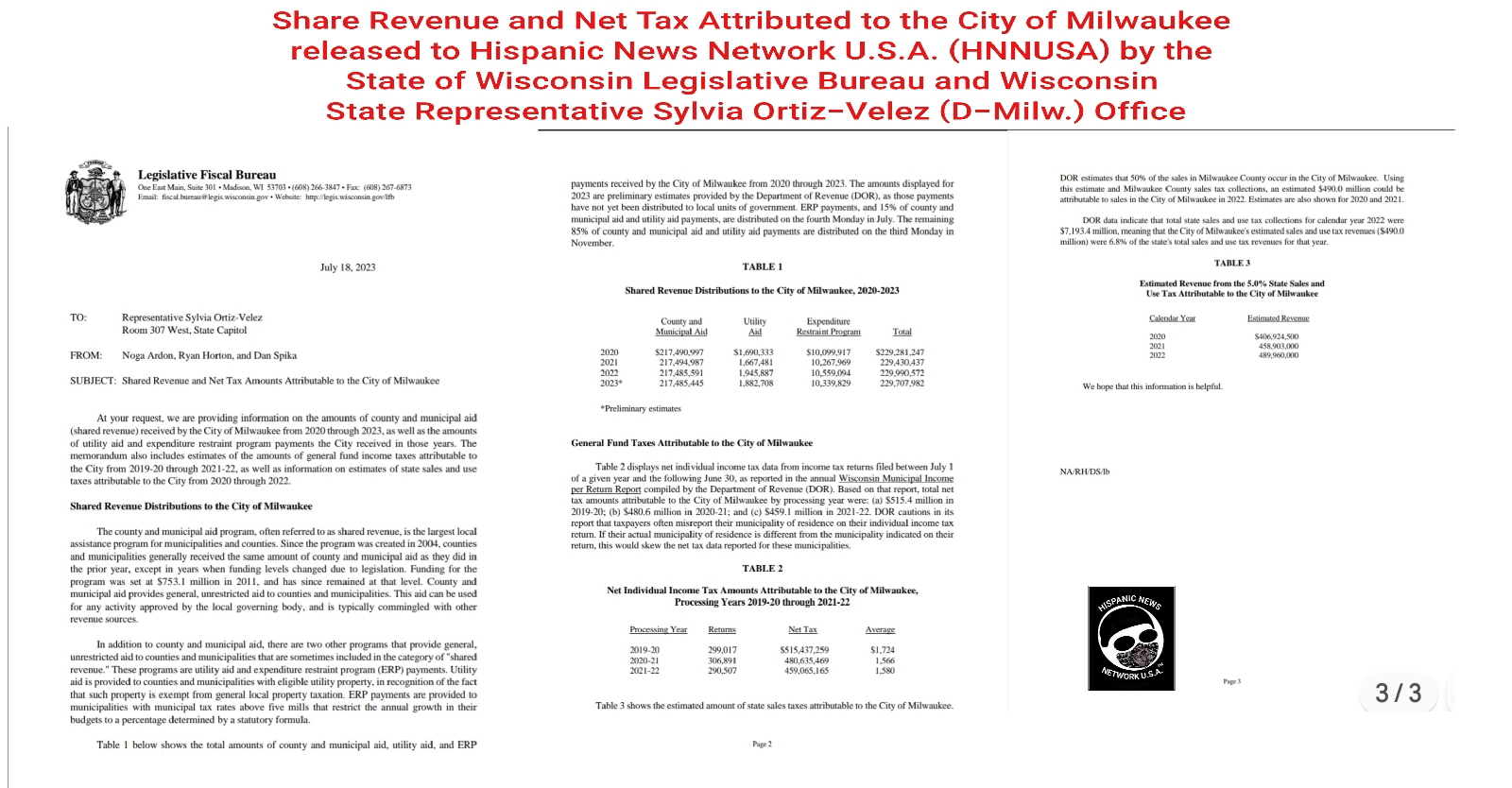

Milwaukee County pays nearly $3B in taxes to the State per year and the State only returned $230M in Share Revenue for 2023.

The City of Milwaukee also pays the State more than its fair share of combined taxes to the State and it only returns about $219.4M for the City of Milwaukee to operate efficiently. The estimated total of combined taxes that the City pays the State is undetermined, but it pays more than any other municipality in the State.

Since 2018, the Republican controlled legislature made it possible for the Wisconsin Department of Revenue to stop reporting or tracking how much municipalities pay the State in totaled taxes.

For any elected public official to support and vote for a tax increase in Milwaukee County and the City should not be re-elected, simply because they have failed to challenged the State for not returning more of the Share Revenues needed to operate the City and County efficiently.

The State of Wisconsin reported a $7B tax surplus for 2023.

Lastly, It also looks like the majority of Milwaukee Common Council members who voted for the 2% Sales Tax increase seemed to benefit because they are included in the pension fund, which no doubt can be considered a conflict of interest.

The Common Council failed to put the 2% Sales Tax increase in a referendum vote for the City of Milwaukee taxpayers to decide, if an increase was needed, instead for the Common Council who will benefit in securing additional tax funding for their own pensions to decide a 2% Sales Tax increase was actually needed, through the guise that it would save City jobs instead of suing the State to get more Share Revenues returned to the City in order to operate efficiently and without an annual Gap.

Update:

No comments:

Post a Comment